Imagine standing at the edge of a financial cliff, your dreams of real estate riches spread out before you like a glittering cityscape. You're about to take a leap, but here's the kicker – you've got a secret weapon. It's not a parachute; it's a catapult. That catapult? It's called leverage.

Welcome to this installment of the Golden Keys of Real Estate Series, where we're unlocking the vault of property prosperity. Today's golden key is Maximum Leverage - the financial sorcery that turns modest investments into mammoth returns, and then multiplies those returns exponentially.

To put it in perspective: Without leverage, my average return would have been 2.3 times my investment. With leverage? A jaw dropping 5.4 times. But then the magic really happens: After several rounds of this, I ended up with about 10 times as much real estate as I would have without debt.

That's the power of compound leverage—it's not just addition, it's multiplication on steroids.

But be careful: leverage is like fire. It can warm your home or burn it to the ground. So before you strike that match, let's break down the 11 factors that'll determine whether you're about to light a cozy fireplace or a raging inferno.

GROUP A: Property Specific Factors

1. Property type: Not All Bricks Are Equal.

Picture this: A cute house on a cul-de-sac, selling for 20% less than market value. Your friendly neighborhood banker gives you a high-five and an 80% loan. Cha-ching! You're doubling your money faster than you can say "real estate tycoon."

But wait, there's more! Right next door, three ready-to-build lots are begging for attention at an even juicier 30% discount. You swagger back to the bank, expecting an even bigger payday. Instead, your banker's smile fades, and they reluctantly offer to finance only 50% of the purchase price.

Welcome to the confusing world of property leverage, where sometimes a 20% discount trumps a 30% one.

Here's the lowdown on which properties make bankers drool:

a) Homes trump businesses, because even in tough times, people still need a place to live.

b) Multiple tenants (think apartments, self-storage) beat single tenants (think of a Walgreens). Imagine your income as a river – more streams mean less chance of running dry.

c) Occupied beats vacant, because cash flow is king – and it’s what pays the mortgage.

d) Versatility trumps specialty. A plain warehouse? Gold. A niche building like a hockey rink – Yikes.

2. Property Condition: Beauty is In the Eye of the Banker.

A fixer-upper might be your dream project, but it's a banker's nightmare. Expect to pony up more cash for that "charming" property with "character."

Exception: net lease buildings get a pass here, since the tenant takes on improvement risks. And if you’re into fix and flips, some specialty lenders will give you extra leverage, betting on your own sweat equity to sweeten the deal.

3. Cash Flow: Show Me The (Monthly) Money.

It’s simple: the higher the cash flow, the more debt you can afford. Banks use terms like "Debt Yield" or "Cash Flow Coverage" to determine how much they'll lend, but here’s the bottom line: they'll want your property to make 1.25 - 1.4 times as much cash as your mortgage payment.

Word of caution: Low cash flow is often reserved for the “safest properties”. But low cash flow + low interest rates + high leverage = recipe for disaster if rates spike. Just ask anyone who invested in “safe” apartments between 2021-2024.

GROUP B: Market Driven Factors

4. Market Trends: From Darlings to Duds.

Remember when San Francisco office space was hotter than a fresh iPhone release? Then COVID hit, and suddenly those gleaming towers were about as popular as a sneezing contest. The lesson? Market trends turn fast, and loan committees go from hot to cold with the turning of the tides.

Note: you can use this plot twist to your advantage – buy all cash and refinance when your property is back in fashion.

This works in the other direction: when markets are hot, you’ll often get MORE leverage than normal as banks expect growth to help you cover your payments.

5. Interest Rates: The Invisible Puppeteer.

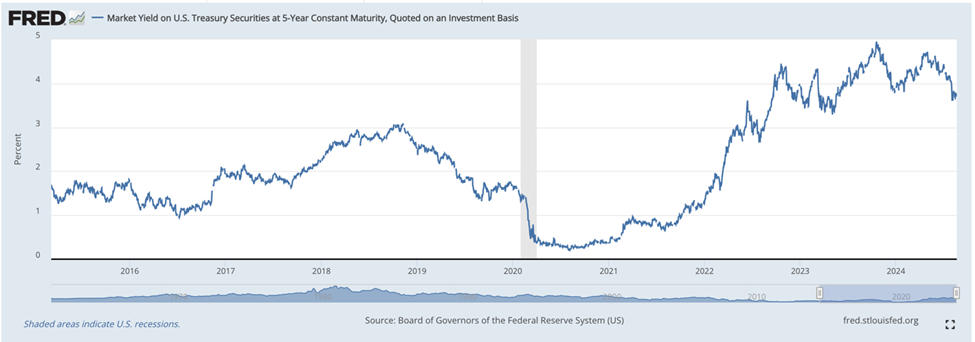

Picture this: It's 2020, and I'm on cloud nine. I've just snagged a sweet portfolio loan at 3.3% interest and 75% leverage. I'm feeling like the Wolf of Wall Street, minus the legal troubles.

Fast forward to 2024, and I'm refinancing the same deal with a 6.7% interest rate and 62% leverage, watching my cash dry up and wondering if I should've invested in a time machine instead.

Interest rates are like tides – they come and go. Plan accordingly so you don’t find yourself underwater.

6. Economic Cycles: The Real Estate Roller Coaster.

During boom times, banks are flooded with deposits and desperate to find places to loan that dough.

But when the cycle turns and deposits dry up, suddenly they’re taking an oversized magnifying glass to every line item in your loan application.

Nugget of Wisdom: When banks are throwing money at you, take less. It's counterintuitive, but it might just save your bacon when the market turns.

7. Location, location, location. (And Density).

Big city properties get the VIP treatment. Rural areas? Not so much.

Sure, you get more cash flow in the sticks. But when things go south, good luck finding tenants, or buyers, for your middle-of-nowhere investment.

Insider info: Some banks like Wells Fargo will base their entire lending strategy on whether you’re in a major metro. Consider off the beaten track lenders for off the beaten track investments.

GROUP C: Investor and Lender Factors

8. Your Experience: A Real Estate Resume.

First-time flipper? Prepare for an uphill battle, but through a thick jungle, with a rusty machete.

Got a track record of delivering profits? The banks will be eating out of your hand.

9. Your Creditworthiness: Financial Fitness Test.

Early in my career, I was real estate-rich but cash-poor. Banks acted like I was trying to spend Monopoly money. They worried (correctly) that I might not cover any shortfalls.

What to expect: Banks will run your credit score and ask for financial statement showing all of your assets.

Pro tip: Keep a detailed financial statement and update it monthly. It’s like a fitness tracker for your wallet so you’ll always know where you stand.

10. The Loan Committee: The Mystery Behind The Curtain.

Sometimes, it will feel to you like banks decide on loans by throwing darts at a board. Each bank has its quirks – get to know them like your friend’s coffee order.

There are cash flow lenders, MSA-based lenders, ratio lenders, relationship lenders – and sometimes banks will play the chameleon and change their approach just because they hired a new VP of Lending.

11. The Source of the Loan: Lender Speed Dating.

National banks play it safe. They’re like your buddy who wears two masks in his own car. Local banks get a bit more frisky (especially in their backyard). Credit unions focus on relationships, while private lenders might be willing to take on projects that make traditional lenders run for the hills.

Remember: Choosing your lender is like picking a dance partner for the real estate tango. The right one can make you look like a property mogul. The wrong one? You’ll end up with more bruised toes than profits.

We've journeyed through the 11 factors that shape the property leverage landscape, from the fickle nature of interest rates to the mystery behind bank loan committees. It's a wild ride, isn't it?

But here's the thing – in this game of financial Jenga, every piece matters. As you step into your next deal, take a moment to reflect on these factors. They're not just numbers on a page; they're the building blocks of your real estate empire. So, whether you're eyeing that cute house on the cul-de-sac or that sleek downtown office building, remember: in real estate, knowledge isn't just power – it's profit. Now go out there and show those bankers what you're made of!